1031 Exchange Services

MAXIMIZING VALUE & RETURN ON EQUITY

1031 Exchanges allow investors to trade up and defer taxes.

Andy is a leader in 1031 exchanges. His long term relationships with owners, investors, and brokers allow him to match properties with exchange buyers with speed and efficiency. His long-term relationships with owners and investors of every major property type allow us to match properties and exchange buyers with speed and efficiency.

Leveraging the Market

Owners of investment properties struggle with finding ways to take advantage of the built-up equity in their income-producing properties and increase their return on equity while deferring payment of capital gains taxes. The current market environment encourages private investors to upgrade or reposition their real estate holdings.

Make Informed Decisions

While 1031 exchanges have gained increasing popularity, each investor should evaluate their own situation and objectives.

The first step is to have a qualified real estate agent evaluate your property to determine market value and then discuss the tax alternatives with your tax advisor. In some instances, it may be worth taking the cash and paying capital gains taxes, considering that interest rates remain historically low.

On the other hand, an exchange may be the key to unlocking built-up equity and providing the opportunity to expand a portfolio and create greater wealth. The biggest mistake would be not to know your alternatives.

Benefits of a 1031 Exchange

With proper guidance from a tax professional or attorney, well-informed investors are utilizing the 1031 provision in the Internal Revenue Code, also known as a Starker exchange, to meet the dual objectives of “trading up” to larger or higher-quality properties, while at the same time deferring capital gains taxes. Some investors, especially aging baby boomers, are trading into properties that are less management intensive.

Knowing the Basics

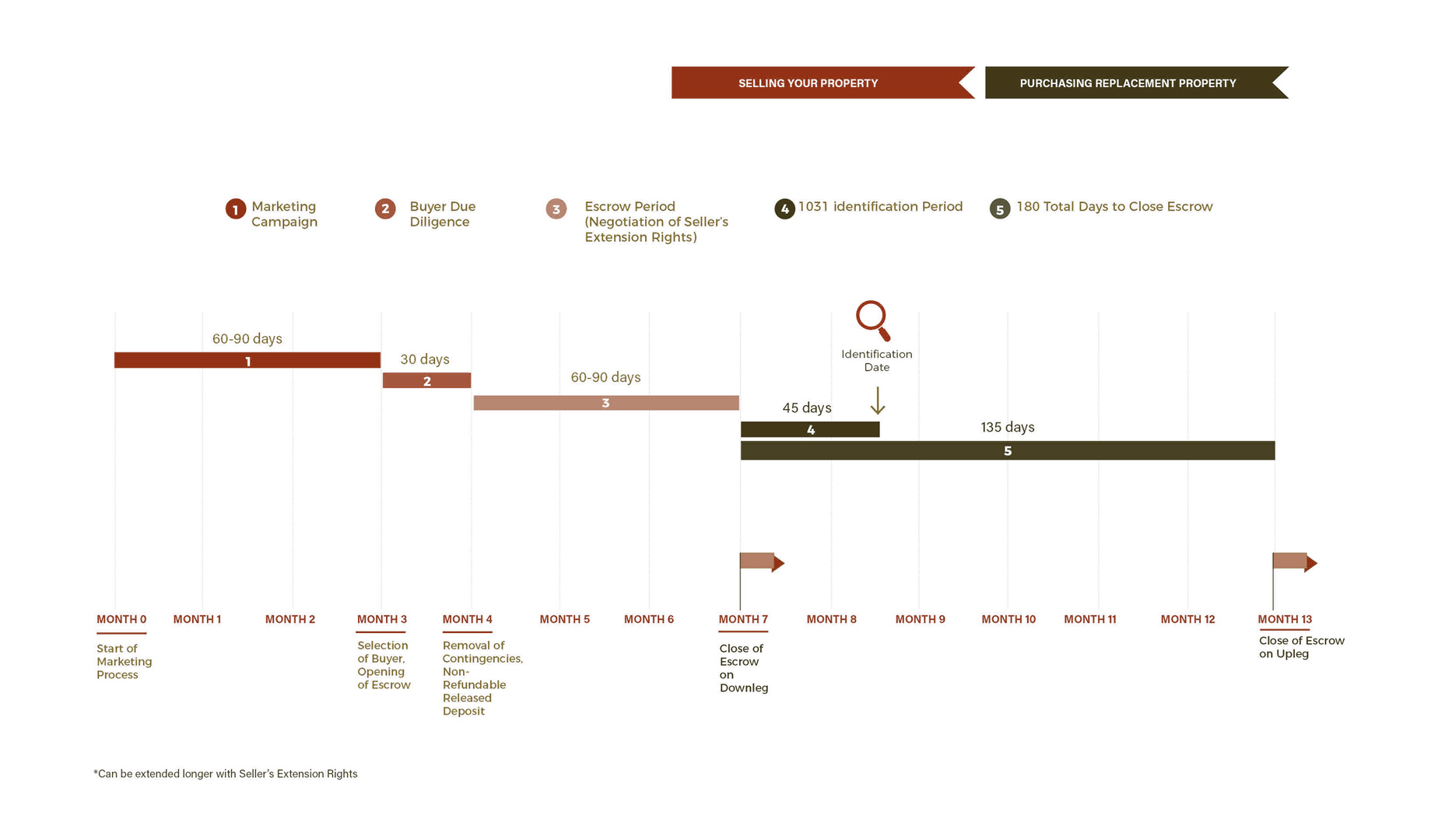

While there are three basic types of exchanges—simultaneous, reverse and deferred—95 percent are deferred. When selling an investment property, the code allows a seller 45 days from the close of escrow of the relinquished property (the “down leg”) to identify up to three replacement properties (the “up leg”), and an additional 135 days to close escrow on at least one of the identified properties.

Alternatively, more properties can be designated if certain valuation tests are met. The seller must contract with a neutral third party, known as a qualified intermediary or accommodator, to hold the funds from the sale of the relinquished property and to purchase the replacement property for the seller’s benefit.

Completing this process allows sellers of real property held for investment purposes to delay or defer the payment of capital gains and recapture the depreciation tax benefit. Deviating from the process described above may result in tax consequences or costly penalties.